The Professional Indemnity Market 2021

Recently Tom Lyes, Director of Engagement at Lawyer Checker met with Professional Indemnity Specialist Jenny Screech from Howden Insurance Brokers, about PII ahead of October’s renewals.

Recently Tom Lyes, Director of Engagement at Lawyer Checker met with Professional Indemnity Specialist Jenny Screech from Howden Insurance Brokers, about PII ahead of October’s renewals.

Professional Indemnity Market 2021 overview

Recently Tom Lyes, Director of Engagement at Lawyer Checker met with Professional Indemnity Specialist Jenny Screech from Howden Insurance Brokers, about PII ahead of October’s renewals.

You can catch up on the recording here.

Tom and Jenny covered a range of topics that are important for conveyancer’s as they prepare their insurance renewals:

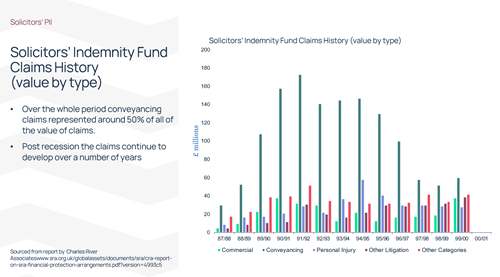

Howden Insurance Brokers agree with recent media reports that it is the hardest PI market for over 20 years. In the previous 20 years, there have been only three occasions when the Solicitors Indemnity Fund premiums went over £300m – one of which was in 2019/20. Insurers are concerned about the conveyancing aspect of legal practice based on previous trends and the other points addressed below.

The premium calculation a firm receives is generally based on:

To understand the outlook for your firm, it is important to talk early with your insurer to understand the impact of such areas.

Firms are encouraged to speak to their own insurance brokers after the 1st April to start to consider their firm’s insurance proposal form. This form will offer insight into what areas your broker is sensitive to, as well as advising further on your firm’s risk management agenda. Proposal forms are longer than ever before and leaving completion until short notice could be costly.

Brokers are increasingly focused on a firm’s financial position, with a recent report from the SRA citing that 47 firms went into an extended policy period last year. (This is where if your firm’s insurance renewal is not successful, and the firm has 60 days left to practice on current instruction before closure). In September 2020 83 firms closed, some of who’s Professional Indemnity Insurance was not renewed by their broker.

The fallout of the pandemic is yet to be fully assessed and will factor in Professional Indemnity Insurance for years to come. Investing time from April in preparation of renewal in October is vital to safeguard your firm’s practice.

Speak confidentially with Tom Lyes, Director of Engagement to discuss your firm's needs.

Further reading

www.howdengroup.com/uk-en/howden-solicitors-market-report-jan2021

www.howdengroup.com/uk-en/representation-presentation-solicitors-pii-renewal